Medigap Agent Near Me for Beginners

Wiki Article

Medigap Agent Near Me Can Be Fun For Anyone

Table of ContentsHow Medigap Agent Near Me can Save You Time, Stress, and Money.6 Easy Facts About Medigap Agent Near Me DescribedTop Guidelines Of Medigap Agent Near MeThe Ultimate Guide To Medigap Agent Near MeThe Only Guide to Medigap Agent Near Me

These tasks might consist of advertising, modern technology, training, as well as conformity; the agencies offer as an intermediary between representatives as well as insurance providers. Unlike enrollment commissions, management repayments are not established by any type of regulating or regulatory body; instead, they are established by insurance providers in settlement with each independent agency. For MA and also Component D, CMS's Medicare advertising standards establish that these repayments "should not exceed FMV or an amount that equals with the quantities paid to a 3rd event for similar solutions throughout each of the previous two years." These repayments provide one more network of financial assistance in between insurers as well as companies and also agents.

Our analysis from 2016, 2018, as well as 2020 suggests that given that average premiums in Medigap have actually dropped, representative settlement (a percent of the costs) also has actually lowered. On the other hand, while MA premiums have actually lowered, agent settlement (established by CMS) has increased at a rate that has exceeded inflation.1 Our evaluation has 4 core implications for policymakers.

The 6-Minute Rule for Medigap Agent Near Me

Increasing openness and reporting on service providers' actual compensation payments as opposed to the CMS-defined maximums across MA, Component D, and Medigap could assist resolve this. Policymakers additionally must think about additional regulative clearness around the administrative settlements, bonus offers, and also other types of settlement.MA and also Part D strategies are determined with the star rankings program and also are compensated in different ways for providing a high-grade participant experience. Making sure payments even if recipients remain with their original plans might assist prevent unneeded changing.

Policymakers might take into consideration defining a minimum degree of service needed to make the renewal or switching compensation. Agents are a vital source for recipients, yet we ought to reimagine compensation to make sure that rewards are much more carefully lined up with the aims of giving assistance as well as advise to beneficiaries as well as without the danger of competing financial passions.

Not known Factual Statements About Medigap Agent Near Me

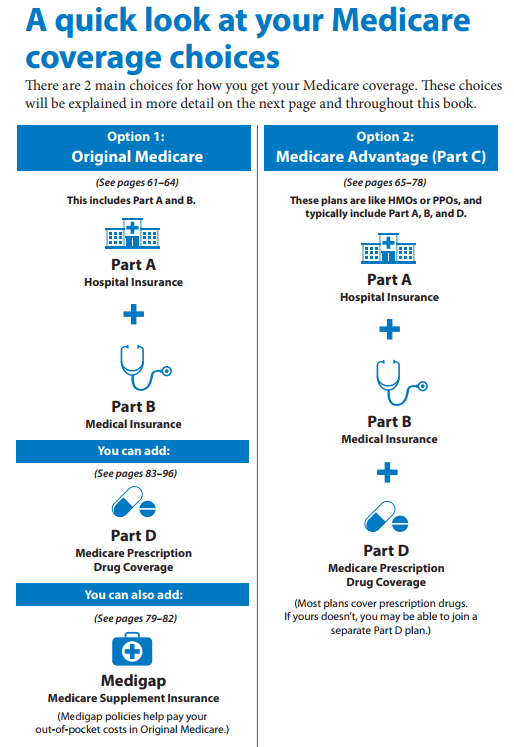

It's usual for individuals searching for a new medical insurance plan to experience an insurance coverage representative, yet is this necessary when it involves Medicare? The circumstance will certainly differ depending upon the kind of Medicare you want. If you do select to opt for an agent, the information can still make the procedure vary commonly.If you're simply intending to register in Original Medicare (Medicare Components An and also B), after that you won't require to make use of an insurance policy representative. Actually, you will not have the ability to use an insurance coverage agent-- this kind of Medicare is just offered from the federal government. Insurance representatives will certainly never come into the picture.

This is because Component D plans are sold by exclusive insurer. Medicare Advantage is by far the most common kind of Medicare insurance coverage that is sold through insurance policy representatives. Medicare Advantage plans, also referred to as Part C strategies, are essentially a way of getting your healthcare protection with an exclusive strategy.

How Medigap Agent Near Me can Save You Time, Stress, and Money.

Some Component C intends included prescription drug strategies packed with them, and some do not (Medigap Agent Near me). If yours does not come with a PDP, after that it can be possible to obtain Part C from one firm and Component D from an additional, while working with 2 different representatives for every strategy. Medicare Supplement intends, also called Medigap strategies, are plans that cover out-of-pocket expenses under Medicare.These strategies are likewise offered by personal insurer, which implies that insurance policy representatives will have the ability to market them to you. When it comes to Medicare insurance coverage representatives, there are normally two kinds: hostage and independent. Both can be licensed to offer Medicare. Although "captive" has an extremely adverse undertone, it is simply straight from the source used to refer to representatives that benefit just one business, as opposed to representatives that can work with a variety of insurer.

The basic means that you can think about restricted versus independent agents is that restricted representatives are sales agents that are contracted to offer a specific insurance coverage product. Independent representatives, on the various other hand, are much more like insurance coverage brokers, implying that they can offer you any kind of sort of insurance policy item, and also aren't limited to one business - Medigap Agent Near me.

Not known Incorrect Statements About Medigap Agent Near Me

In this method, you company website can consider them as comparable to an auto sales representative; they sell one sort of item for one business, as well as probably are paid via compensation. Independent representatives are just people that offer insurance-related items. They can offer an insurance coverage strategy from Company A to someone and also Business B to one more, which is something restricted representatives just can't do.As you can envision, there is a much higher level of liberty that features collaborating with an independent insurance representative instead of a restricted one. Independent agents can look at every one of the insurance coverage products they have access to and try to find the one that functions finest for you, while captive agents can only sell you one specific point, which may not be a great fit.

Report this wiki page